Can I Drive for Uber With an Out of State License

Sponsored past QuickBooks Cocky Employed

In this commodity, nosotros examine the cost to rent a vehicle for Uber & Lyft versus the cost to purchase a vehicle. This article is sponsored by our buddies over at QuickBooks Self-Employed whom support the site by sponsoring articles centered around the fiscal health of rideshare drivers on the site. If you lot'd like to run your business organisation like a grown-up then bank check them out!

How many miles do you put on your auto while rideshare driving? As more than drivers track their miles, they're beginning to discover out, in some cases, that they're putting a ton of miles on their cars. Some drivers are deciding it's meliorate to rent a car and not worry so much about mileage than to put that article of clothing-and-tear on their vehicles. But are they really a skillful long-term commitment? Or is it cheaper to rent a motorcar than it is to buy one and pour maintenance and miles into it?

Let'south notice out!

Should yous rent or buy a car to drive for Uber, Lyft, etc?

Renting vs. Owning Compared

Let's use a driver in Los Angeles who drives about 45 hours a week using unlike cars. He earns $42,200 a yr in fares (later commision and earlier expenses), and put 51,707 miles on the car each year equally a function of earning those fares. Using this, I compare the costs to operate a vehicle for rideshare between 3 different options: Lyft's Limited Drive, a third-party rental visitor, and financing a used 2022 Prius.

In add-on to Lyft'south Express Drive, in that location is a growing industry of other rental companies for gig-workers. Each is a little unlike than Express Drive and near are also more expensive. Y'all tin can read more nearly them all on our Vehicle Market.

- HyreCar

- Hertz Rental

- Maven Gig

- Fair (formerly Xchange Leasing and coming soon)

- Getaround (SF Only)

- Rideshare Rentals (LA just)

- …and more than.

Click here to see all the means you tin hire a auto to drive for Uber and Lyft.

If you lot're not sure whether you should rent or buy and live in San Francisco, bank check out Gig car share!

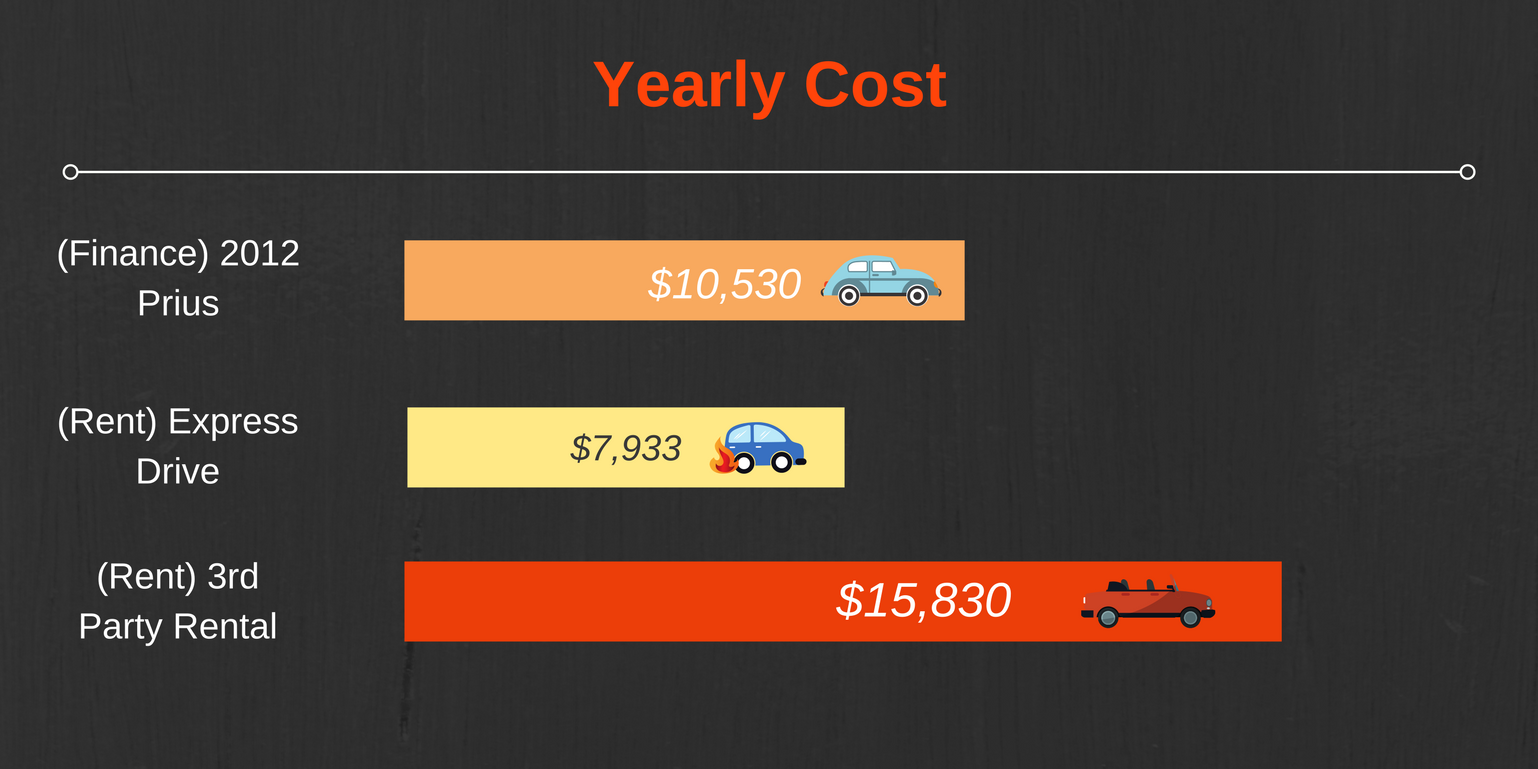

Yearly Costs Summarized and Compared

Yearly Costs For A Sharing Economy Vehicle

- Financing a 2022 Prius: $10,530

- Renting with Lyft Express Drive: $vii,933

- 3rd Party Rental Company: $xv,830

Renting With Lyft Limited Drive

I chose to use Lyft'south Limited Bulldoze as an case because it offers a unique "Rental Rewards" program. It's a special matter from Lyft where if yous provide a certain number of trips each week, you'll get refunded all or well-nigh of the cost of the rental. Our model assumes our driver fails to meet the trip requirement half-dozen weeks a yr.

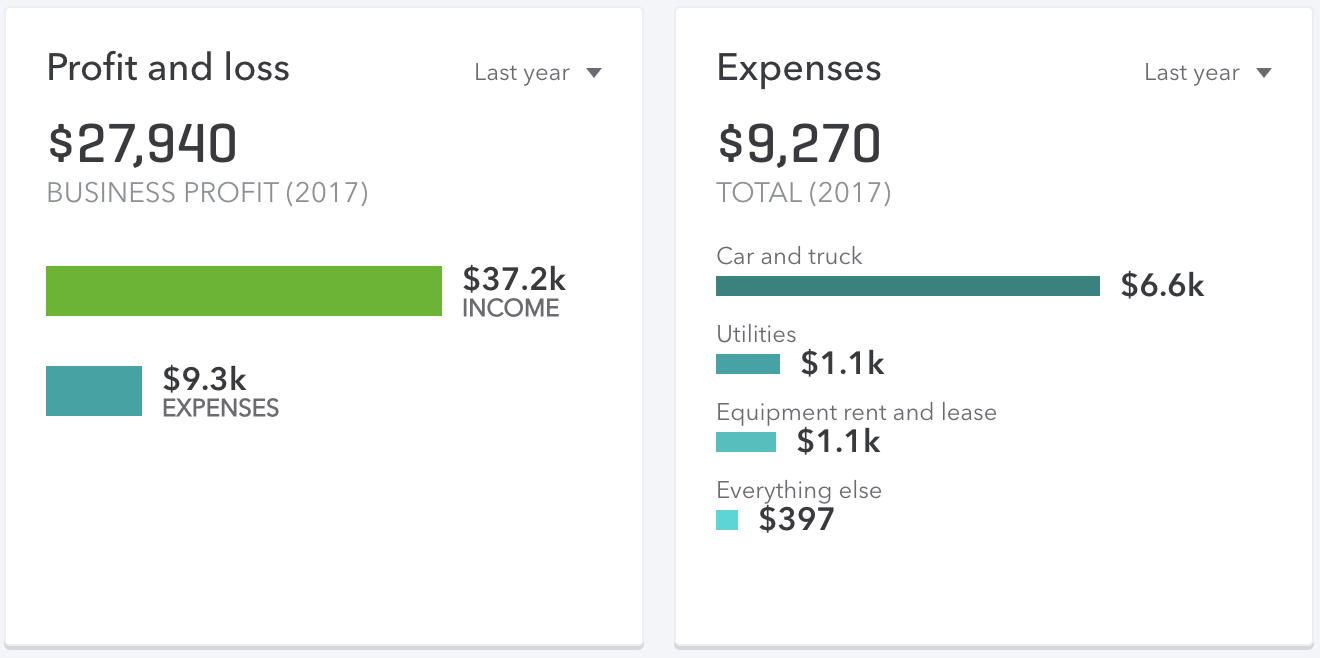

Using Express Bulldoze "locks" y'all into the Lyft platform and disqualifies you lot from most extra earnings incentives like Ability Zones and Power Driver Bonus. This results in slightly lower gross earnings of $37,200 throughout the year.

H igh-level Profit & Loss in QuickBooks Self-Employed : 1 twelvemonth of Lyft Express Drive.

Yearly Express Drive Operating Costs

- Rental Deposit: $250

- Rental Fees: $1,083 (From missing "Rental Rewards" 6 times a twelvemonth)

- Gasoline: $5,970 (2017 Chevy Cruze, 34 combined mpg)

- Maintenance: $0

- Wash and Road Services: $630

- Insurance: $0

Total: $vii,933

Lyft'due south Limited Drive offers a Rental Rewards plan that will eliminate or greatly reduce the cost to rent each week for drivers who complete a minimum number of rides each week.

These numbers assume that our total-time driver fails to meet the ride requirements for rental rewards six times a yr. All the same, someone who never hit the "Rental Rewards" bonus could theoretically run into costs every bit high as $9,386 in rental fees per twelvemonth!

Is information technology worth renting a car for Uber? It's definitely a very good option – check out all the vehicle marketplace rental options in your city here.

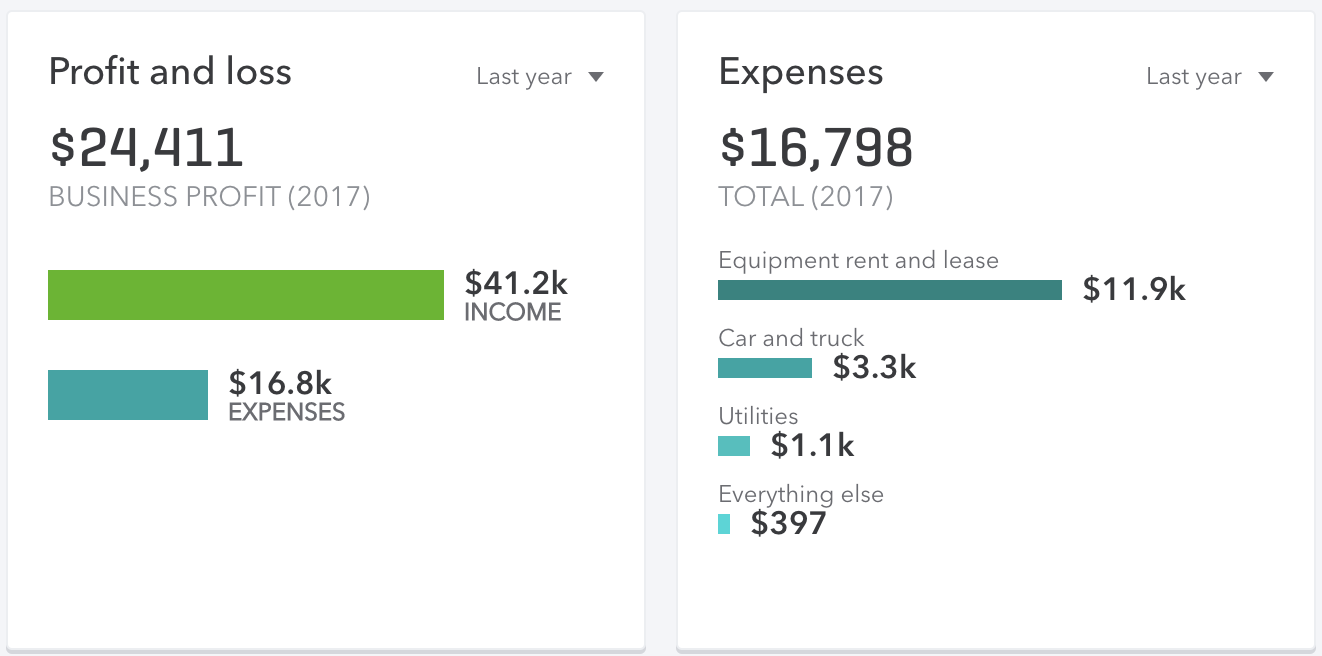

Third Party Rental Companies For Uber & Lyft

Most of these companies charge between $40 to $50 a twenty-four hours for their rentals afterwards insurance and fees. For instance, renting a 2012 Prius through Hyrecar for 280 days (this is assumes our driver takes an boilerplate of 1.6 days off a calendar week) would cost $11,926.30 earlier gas, and cleaning costs. That doesn't include the cost of getting to and from your rental (aka switching costs).

One argent-lining to using a 3rd party rental company though is that it allows you lot to drive for Uber, Lyft, and almost other on-demand services while still collecting bonuses like Uber Quest or Lyft Power Driver Bonus.

Dashboard in QuickBooks Self-Employed showing the costs of renting for ane-year with a 3rd party-rental

Yearly Rental Operating Costs

- 280 Days Rental: $11,926.thirty

- Gas Cost: $three,274

- Wash and Route Services: $630

Total: $15,830.xxx

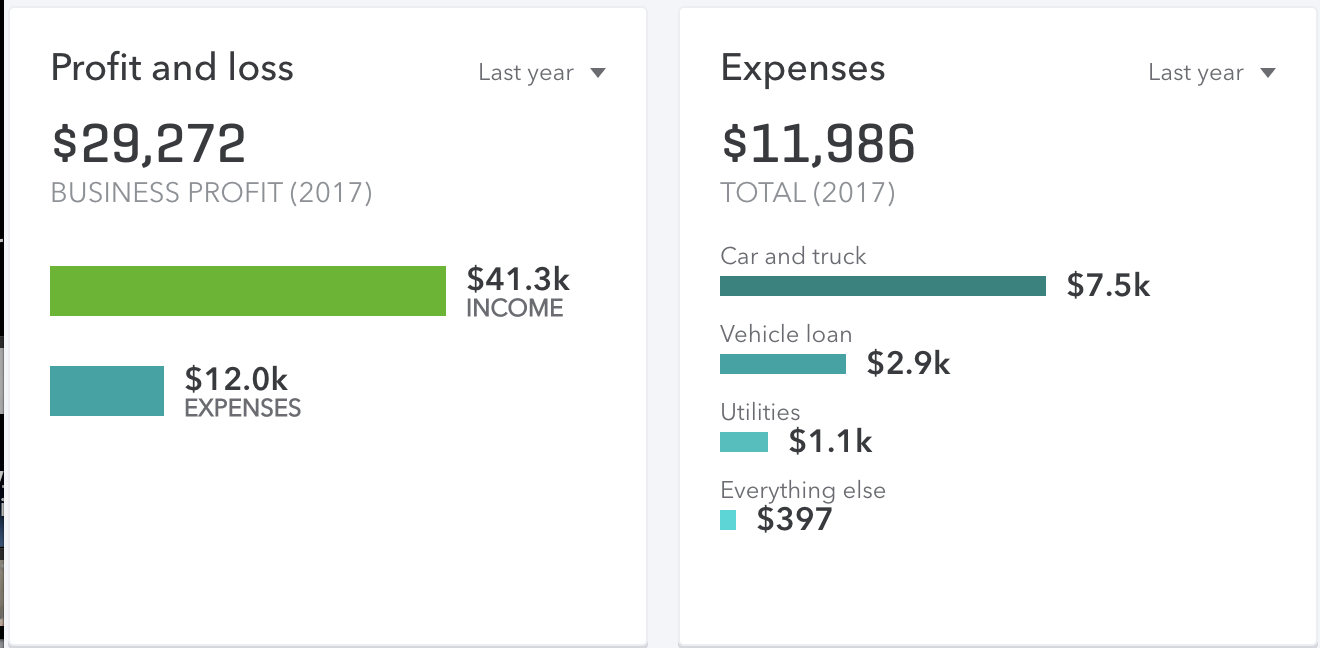

Financing a 2022 Prius

We found a 2022 Toyota Prius for sale in Los Angeles at Galpin Toyota for $13,995. It has 66,523 miles on the odometer. We presume our driver financed this Prius at iii.59% April with a $1500 down payment and a loan term of 60 months. This makes the payment come out to $253 per month.

Dashboard in QuickBooks Self-Employed showing the costs of operating a financed 2022 Prius.

Yearly Vehicle Operating Costs

- Motorcar Payment: $2,924.23

- Gasoline: $3,274

- Maintenance: $ii,240

- Launder and Road Services: $630

- Insurance With Rideshare Addendum: $i,492.20

Total: $10,560.43

How Much Does Your Interest Rate Actually Affect Financing Costs?

Costs tin vary a lot based on the % APY of an automobile loan. For example, the same loan with the aforementioned terms merely with 10% Apr costs an additional $470 in the first year of ownership and would up the monthly payment from $253 to $294.87 a month.

You can summate the details of any given loan for whatsoever given machine using this Auto Loan Amortization Reckoner.

What About Traditional Leasing?

If nosotros ran a traditional lease through this simulation our commuter would owe around $viii,000 in over mileage charges on top of the other costs. I'd show you a graph of that but it'd be NSFW and pixelated.

The but fourth dimension you may get abroad with information technology is if y'all are already leasing a car that yous rarely use and that you look to turn in far, far below the mileage limit. For case, my grandma could probably get abroad with information technology because she leases a Lexus 300 IS F Sport AWD that she drivers 4.iii miles to work everyday and the lease allows for like 10,000 miles a yr.

Possibly I should borrow that Lexus for some Select/Lux driving…

Click here to see all the options for renting a car to drive for Uber, Lyft, etc.

Your Financial Situation Is Unique

Every driver, market, and vehicle is different. There are an endless combination of variables when it comes to calculating the all-time car for driving in the gig-economy. The only manner you will truly know your own numbers is if you rails them yourself using something similar QuickBooks Self-Employed.

Our partnership with them allows you to get a free-trial for 30 days without having to brand a commitment so requite it a examination run if yous'd like to support the site 😀

Renting Has A Large Tax Disadvantage

So far, I've but covered the toll to operate before taxes.

Notwithstanding, when you rent property for business employ, you can only deduct the actual costs of renting that equipment for your business organization. This applies to your vehicle rental too.

Which also means yous cannot accept that juicy $0.545/mile IRS Standard Mileage Deduction!

Renters can deduct their costs to rent plus their bodily driving expenses similar gas and road services. Even then, they tin only deduct the portion of the rental use that was for concern.

Nevertheless, if y'all ain (or lease) your vehicle, you can nevertheless take the Standard Mileage Deduction for all those concern miles, which in our example would event in a whopping $28,180.32 tax deduction!

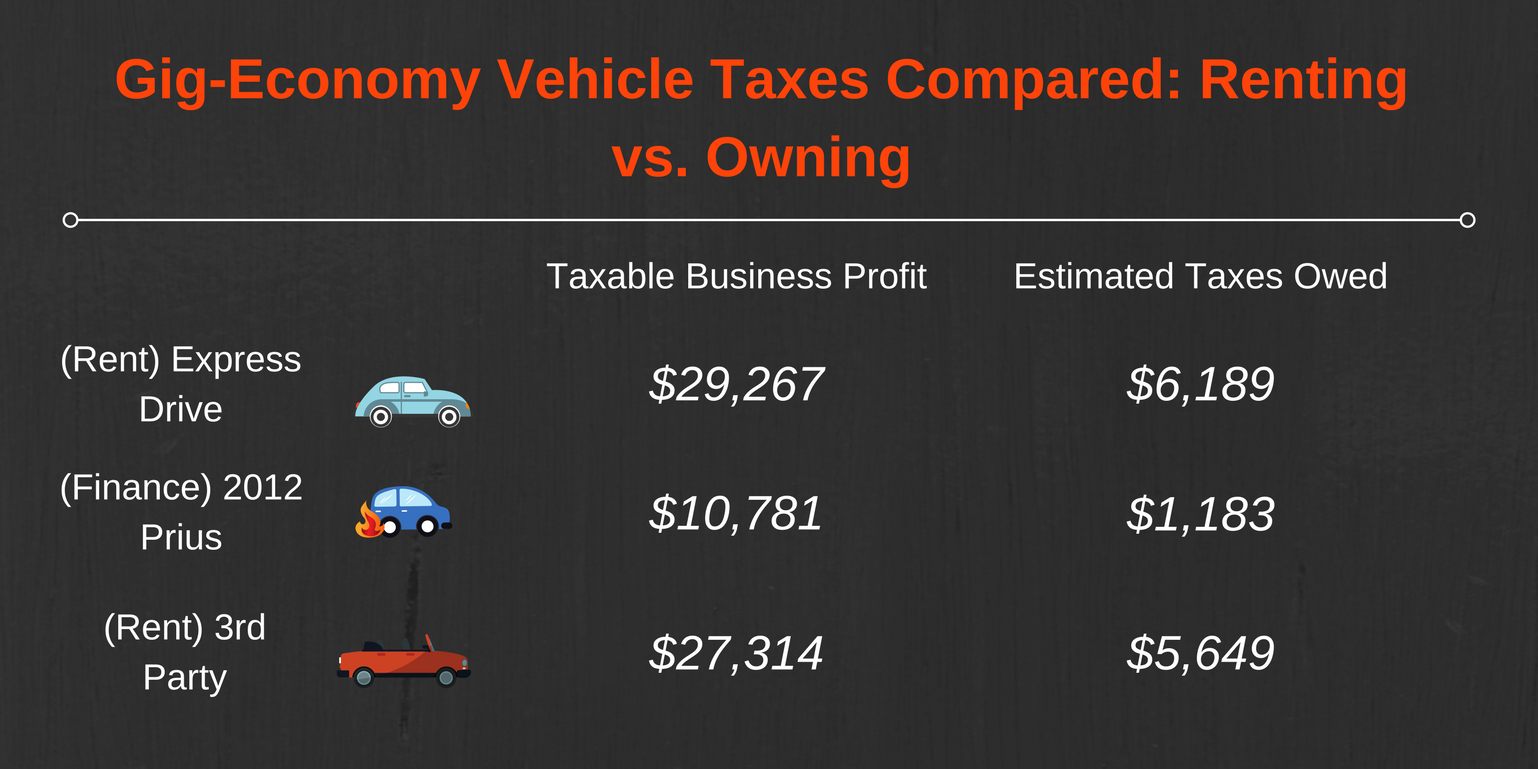

Gig-Economy Vehicle Taxes Compared: Renting vs. Owning

Taxable Business Profit / Estimated Taxes Owed:

- Limited Drive Chevy: $29,267 / $6,189

- (Own) 2022 Prius: $10,781 / $one,183

- (Rent) 2022 Prius: $27,314 / $5,640

Conclusion: Owning your rideshare vehicle tin issue in paying FAR LESS in taxes if y'all put a lot of business miles on it and take the IRS Standard Mileage Deduction.

Final Earnings After Expenses & Taxes

Gross – Expenses – Taxes = Turn a profit

- Express Bulldoze: $37,200 – $9,270 – $6,189 = $21,741

- (Own) 2022 Prius: $42,200 – $11,986 – $1,183 = $29,031

- (Rent) 2022 Prius: $42,200 – $16,798 – $5,640 = $nineteen,762

Related: Is the Toyota Prius the Best Car for Rideshare Drivers?

Getting The Right Car Makes All The Departure

As a rideshare driver there'due south only then much you tin do to control how much you earn. Still, i thing you'll have complete control over is how much yous spend on your car.

If there is annihilation nosotros can have abroad from this practice, information technology's that getting into the right machine is probably the about of import part of getting setup as a rideshare driver. Making the incorrect choice could toll you $nine,269 a year!

Our "test" commuter worked the same hours, on the aforementioned days, and drove the same amount of miles throughout the year in Los Angeles. His choice to rent or own his automobile meant a difference of $9,269 in accept abode pay for 2017.

Renting Can Get Your Foot In The Door

Renting isn't all bad. If you need a job and really can't become into a new loan right now (for whatsoever reason) than renting tin can lend you a hand in getting back on your feet. If you lot exercise so, I recommend taking following approach:

- Rent for as brusque a fourth dimension as possible.

- Record every. single. penny. (and mile) using an app like QuickBooks Self-Employed.

- Make a budget to purchase the cheapest rideshare car yous tin.

- Use Lyft'southward Express Drive, read their T&Southward and hit their Rental Rewards plan every calendar week.

- Buy the cheapest Japanese four-door, four cylinder from 2004 that qualifies for Uber.

Renting is also very useful for casual drivers or those who are getting their toes wet before making a larger commitment to drive in the sharing economy. I highly recommend using a rental before ownership a car every bit a new Uber driver to brand sure you like the gig beginning.

What's Your Toll To Operate?

These are but three wide examples of what it costs to operate your automobile for a year. Everyone'due south costs are unlike though so make sure you run the numbers for yourself and that you do them correct.

30 Days Free Trial QuickBooks Self-Employed

If you haven't already done it yet, utilise our lawmaking to become your first 30-days of QuickBooks Self-Employed for free and watch this video on setting information technology upwards.

I've used information technology for the last 3 years and your examination-run will support the site and futurity content similar this where we lock Christian in a room with accounting software and spreadsheets for a week to create unique, well researched content promoting financial wellness in the gig-economy.

Read next:

- Click here to meet all the ways you lot tin can hire a car to bulldoze for Uber and Lyft

- Essential gear every rideshare driver should have

Readers, what's the total cost to operate your car? Do you hire or own? What kind of car practise you drive?

-Christian @ RSG

Source: https://therideshareguy.com/should-you-rent-or-own-the-car-you-drive-for-rideshare/

0 Response to "Can I Drive for Uber With an Out of State License"

Postar um comentário